Inventory management, from start to fulfilled

Inventora is the all-in-one system for makers and manufacturers.

Keep track of raw materials, finished products, and more!

Features

Take control of your growing business

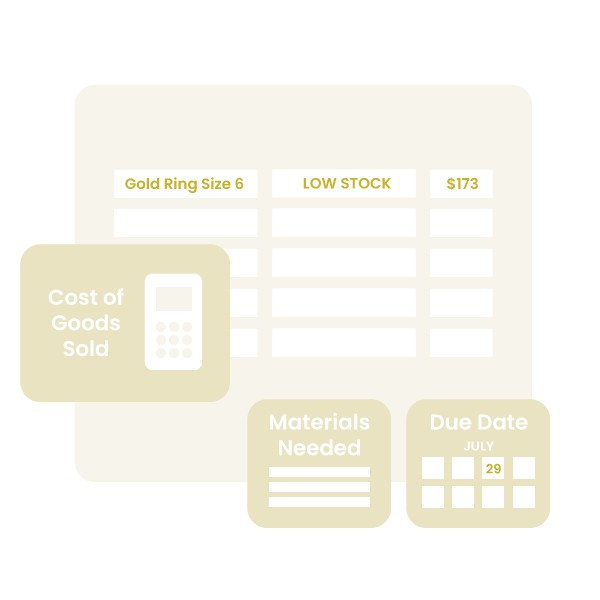

COGS Calculation

Automatically calculate COGS, set retail and wholesale values.

Shop Integration

Sync with multiple platforms to ensure that product inventory never runs out.

Raw Material Tracking

Always know what raw materials you have on hand, as products are made.

Centralized Info

View all of your sales and customers, from multiple channels, in one spot.

Business Reports

Understand your business on a deeper level with inventory and sales reports.

Effective Solutions

Document supply orders, understand unit costs, perform audits, and more.

SHOP SYNC

Integrate with your ecommerce platforms

We offer syncing solutions for Shopify, Wix, Etsy, and Square. Connect to multiple to avoid overselling!

Planned

Queue up production runs by setting due dates and assigning products that need to be created.

Completed

Oversee and reference past production to avoid any miscommunication, overlap, or delays.

In-Progress

View a breakdown of all raw materials needed to complete a production run.

1, 2, 3, Done!

Task management across team members within production has never been easier.

STREAMLINE

Easily manage production

Add team members and take control of the production flow like never before.

Testimonials

"This app has saved me hundreds, if not thousands of dollars, because I never have to question how much I have of a particular material.”

Caitlin Blue

Testimonials

"The best Inventora feature is definitely production. This allows us to see each product we make in each phase of work. I would be lost without it!"

Acadia McGee

Testimonials

“Organization is not one of my strengths, but Inventora makes it so easy. It has been a game changer for my business.”

Erica Boucher

IMPROVE

Make your data work for you

Analyze data quickly and gain insight of inventory as a whole with an easy-to-use interface. Reference total sales across everywhere you sell, and more!

GET STARTED

Join our Hobby plan, for free

Still not sure if Inventora is the solution for you? Test the waters with our free-forever Hobby plan.