Running a business can be strenuous. As makers and manufacturers, we understand how our business taxes can make internal and external operations even harder. There is an unfortunate stigma around the complexity of filing taxes each year for business owners. To keep running our businesses efficiently, we need to stay ahead of the game on taxes. There is, however, one pivotal way to prepare your taxes with maximum automation and ease. This is through using Inventora reports for yearly business tax filings.

By understanding the basic tax principles and what taxes apply to your company based on its structure, you can avoid any surprises that could cost you. With the help of Inventora, filing your taxes will be easier than ever.

This article is for informational purposes only and should not be used as tax or legal guidance. We highly recommend seeking out a lawyer or accountant for more information on your taxes.

How Taxes Impact a Business

Every small business owner in the United States must abide by the law and pay taxes on their company each year. While the exact amount you’ll pay varies by state and business structure, taxes are one of the biggest costs that is associated with running a business.

The average small business pays a 19.8% tax rate on its income. It’s essential to always have this in the forefront of our minds, as we understand how taxes reduce the profits of our businesses. The revenue that’s received will be the primary source of financing for any small business. With taxes being one of the largest business expenses, we must analyze this cost carefully to forecast this expense. If the finances of a business are not critically assessed, the outcome of tax season could be detrimental.

Tax Basics for Businesses

Taxes can be complicated. Therefore, we should start with the basics. First understand that there is no need to get overwhelmed by your taxes if you’re using Inventora to properly store the data and reports of your business. One of the hardest parts of filing business taxes is validating a paper trail of every expense and income dollar your business has seen in the last year. Using Inventora reports for yearly business tax filings helps you hold all the information you need, all year long. No filing folders, no messy desk drawer needed.

Let’s begin by familiarizing ourselves with the fundamentals that likely apply to your company. As we mentioned before, this will depend on the legal structure of your business. Therefore, a sole proprietorship would file differently than a S or C corporation, because this will impact the forms and tax processes.

If you miss a deadline or don’t realize the requirements for your business on certain forms, you could end up paying fees and suffering penalties.

Common Tax Categories

Every business owner needs to know the taxes that apply to their company. This could include, but is not limited to:

- Income tax

- Estimated taxes

- Self-employment tax

- Employment taxes

- Excise tax

Be aware that each state has different requirements, and that tax laws are always changing. Whether you have an accountant, or run your business by yourself, you need to stay acquainted with new changes and how the dealings of your business will affect your taxes.

Important Tax Dates To Know

Once you’re familiarize yourself with the forms and requirements that your business should follow, take time to plot important tax dates on your calendar. This will help you know when you need to file. It’s a good idea to file your taxes well before the deadline is due. In case it takes you longer to complete your taxes, you can now have a buffer period to get what you need in order.

Important Tax Dates

Depending on your business, you’ll either file an annual or quarterly tax return. For example, the due date for filing your tax return is typically April 15th if you’re a calendar year filer. Generally, most individuals are calendar year filers.

If you have a business that operates on a fiscal year basis, your return is typically due on or before the 15th day of the third or fourth month (depending on the type of business entity) after the close of your fiscal year. In instances where this due date falls on a Saturday, Sunday, or legal holiday, the due date is moved to the next business day.

For a comprehensive view of all the important tax deadlines applicable to each taxpayer, please visit IRS Publication 509.

Tax Tools and Resources for Businesses

There are many options to help you stay organized and understand your taxes better. The IRS’s website can seem overwhelming, but it’s packed with everything you need and all the resources for small businesses. These tools and resources will also help you gather all business records. Before filling out any tax forms, you should have all of your records in front of you that report your business earnings and expenses. If you are an Inventora user using Inventora reports for yearly business tax filings, this part will be easy

Inventora is a tax tool available that can help makers and manufacturers. Keep the inventory data and reports you need for your business taxes accounted for automatically within Inventora. Tracking inventory with precision is vital to running a financially secure and lean small business. Mistakes with inventory can affect your bottom line and your tax filing.

Annual vs. Quarterly Tax Filing

Let’s begin with quarterly taxes for small business owners. First off, what are quarterly taxes? The IRS requires most small business owners to make quarterly estimated payments if they expect to owe tax of $1,000 or more. Estimated payments include two types of taxes: income taxes and self-employment taxes.

- Income taxes: This is the tax you pay on all income, including wages, investment returns, and net profit from a business.

- Self-employment (SE) taxes: The self-employed include both the typical “employee” withholding, as well as the matching amount an employer normally pays as well.

Even though you’re paying estimated taxes quarterly, you still need to file an annual federal income tax return. When you file your annual tax return, you calculate your actual tax liability for the year and compare it to the estimates you paid in your quarterly tax payments. If you didn’t pay enough, you’ll owe additional tax. If you paid too much, you can get a refund when you file your annual return.

How are annual taxes different than quarterly taxes? Even though you’re paying estimated taxes quarterly, you still need to file an annual federal income tax return. When you file your annual tax return, you calculate your actual tax liability for the year and compare it to the estimates you paid in your quarterly tax payments. If you didn’t pay enough, you’ll owe additional tax. If you paid too much, you can get a refund when you file your annual return.

Filing Quarterly Taxes with Inventora

One of the most important foundational elements of estimating your taxes is to be organized. Payments are split based on quarters, January-March, April-June, July-September, and October-December. Throughout each quarter you need to maintain a file and keep a record of your profits, expenses, etc.

In order to do this, you can use Inventora reports. If you have the paid plan you’ll be able to see the historical data you need there.

In the reports section on the top right corner, you’ll choose to view your reports for the 1st, 2nd, 3rd, or 4th quarter of the year. By selecting the quarter you’ll be able to view your data on materials and products, such as materials/products purchased and inventory value.

If you scroll down, you’ll see “Inventory Breakdown” you can change the date to the quarter that you want to view. For example 1/1/2023 – 3/31/2023 for the first quarter. Once you change the date you should see 2 numbers: Materials Total Value and Products Total Value. Add these numbers together to get your total inventory for that specific quarter.

Quarterly taxes are not all bad if you plan for them. Mark your calendars, manage your documents, budget accordingly, and send your payments in on time. The key is to create consistent habits, to keep your business financially stable throughout the year.

Filing Yearly Taxes with Inventora

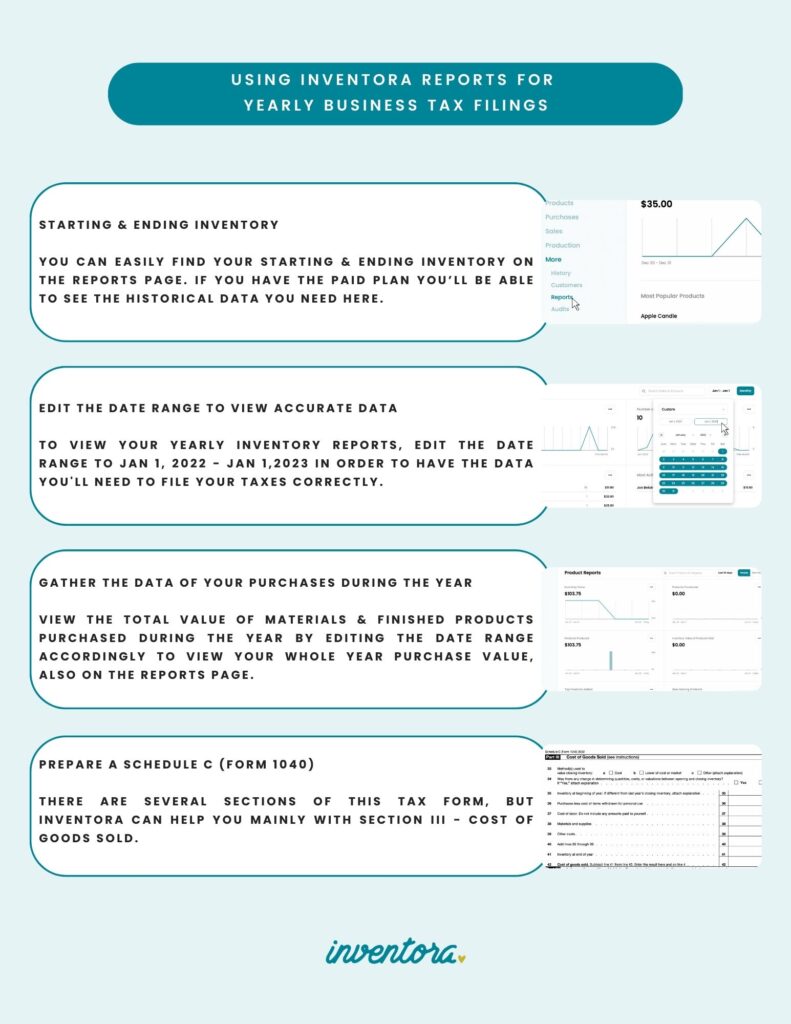

Starting & ending inventory in Inventora is where you will begin when you are using Inventora reports for yearly business tax filings. You can easily find your starting & ending inventory in Inventora on the reports page. If you have the paid plan you’ll be able to see the historical data you need there.

For the inventory at beginning of the year, in the reports section scroll down, where you’ll see “Inventory Breakdown”. You can change the date to the first day of the following fiscal year at 12:00 am. This would be 1/1/2022 and you pay taxes based on the calendar year. Once you change the date you should see 2 numbers; Materials Total Value and Products Total Value. Add these numbers together to get your starting inventory

For the inventory at End of the Year, the process is the same. In the reports section scroll down, where you’ll see “Inventory Breakdown”. You can change the date to the first day of the following fiscal year at 12:00 am. This would be 1/1/2023 and you pay taxes based on the calendar year. Once you change the date you should see 2 numbers; Materials Total Value and Products Total Value. Add these numbers together to get your starting inventory

Gathering Purchase Data Through the Year

In Inventora, it’s easy to find the total value of materials and finished products purchased during the year on the reports page.

If you make your products out of raw materials, then you’ll want to know how much you spend on materials. If you order finished products to sell, then you’ll want to track how much you spend on these, similar to raw materials.

You can do this simply by changing the date range from 1/1/2022 through 1/1/2023. Inventora will then show you with a large black number your total materials and materials purchased.

Preparing a Schedule C (Form 1040)

If you’re based in the United States, then the most common tax document you’ll need to prepare as a small business is the Schedule C (Form 1040). There are several sections of this tax form, but Inventora can help you mainly with Section III – Cost of Goods Sold.

Here are the values we recommend:

33. Method(s) used to value closing inventory: cost.

34. Was there any change in determining quantities, costs, or valuations? Yes if previously used something other than Cost, otherwise no.

35. Inventory at beginning of year: Review the data you have in Inventora of your inventory at beginning of the year.

36. Purchases less cost of items withdrawn for personal use: See your “Finished Product Purchases”.

37. Cost of Labor: Inventora does not currently track labor costs, so you should calculate this separately. If you’re a business owner, the form recommends not including your own time.

38. Materials & Supplies: See your “Materials Purchases”.

39. Other costs: Inventory at end of year, Review the data you have in Inventora of your inventory of the end of the year.

An accurate inventory count and an accurate value of that inventory will get you fairly close to what should be listed as total profit or loss on your tax return.

Aside from using Inventora, hiring an accountant can be a blessing for your business and an investment well worth the money for peace of mind. Delegation is an integral part of business, and filing taxes is a complicated task that is often better left to the professionals.

What are Business Tax Deductibles?

The lower your profitability is, the less tax you’ll be liable to pay at year end. One way to sensibly reduce profit is by claiming business-related items as an expense.

According to the IRS, businesses can write off any expense that meets these criteria:

Ordinary: One that’s commonly used by other businesses in your industry.

Necessary: One that’s helpful or assists you in growing the business.

Allowable expenses can include:

- Inventory

- Marketing

- Payroll

- Utilities (i.e., heating and lighting)

- Accounting and legal services

- Insurance

- Shipping and delivery costs

- Retail Packaging

- Home office deduction

- Equipment

If you purchased expensive equipment throughout the year Use section 179 deduction to write off the full purchase price and reduce your tax liability.

Again, there are strict rules around how section 179 can be claimed. Equipment must be used for business purposes more than 50% of the time, actively used in the current financial year, and purchased outright. Reading the fine lines will be a crucial part of this process. It’s always wise to meet with an advisor for moments like these.

PRO TIP: POS Plan, apps, and hardware you purchased for your business qualify for Section 179 tax deductions.

Closing Advice

As you can now see, completing your business taxes is not a task left for last minute. Instead of ignoring the daunting chore, arm yourself with the information you need to anticipate all of your tax needs. If you are able to clearly understand your business structure and how that affects your tax schedule, you will be off to a good start.

Continue to be aware of how any government relief can impact your taxes while keeping track of important dates throughout the year. If you supply yourself with the resources available to your business through using Inventora reports for yearly business tax filings, you will complete tax season with ease.

To learn more about Inventora and how it can assist you in the internal functions of your business, sign up for our newsletter below. To get started automating your business today, join Inventora’s hobby plan for zero cost. Or, unlock all Inventora’s features with the affordable business plan.